नवीनतम

नवीनतम

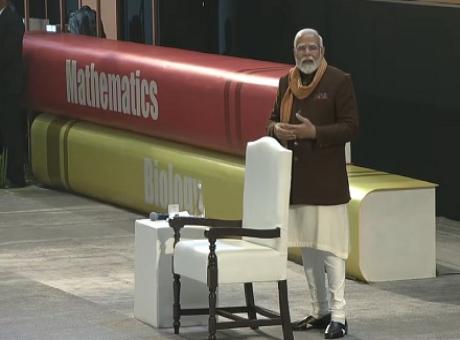

Budget 2026 Highlights

NEW DELHI (Maha Media): The Union Budget for 2026-2027, presented by the finance minister, charts a course for sustained economic growth with a total estimated expenditure of Rs 53.5 lakh crore. The budget is built around three core duties, or ‘kartavyas’: accelerating economic growth, fulfilling citizen aspirations, and ensuring inclusive development under the “Sabka Sath, Sabka Vikas” vision.

A cornerstone of this budget is the significant thrust on infrastructure, with capital expenditure proposed to be increased to Rs 12.2 lakh crore.

This investment is part of a broader fiscal strategy aimed at strengthening the economy while maintaining fiscal discipline.

The fiscal deficit for 2026-27 is estimated to be 4.3% of GDP, continuing the government’s path of fiscal consolidation.

To bolster domestic manufacturing, the budget introduced several key initiatives.

A new Biopharma SHAKTI scheme, with an outlay of RS 10,000 crore over five years, aims to establish India as a global hub for biologics and biosimilars.

The India Semiconductor Mission (ISM) 2.0 will be launched to expand the nation’s capabilities in producing semiconductor equipment and materials.

Furthermore, the outlay for the Electronics Components Manufacturing Scheme has been substantially increased to Rs 40,000 crore to capitalize on its investment momentum.

On the taxation front, the most significant announcement is the implementation of the new Income Tax Act, 2025, which will come into effect from April 1, 2026, promising a simplified tax regime.

In a major relief for citizens, the budget proposes to make any interest awarded by the Motor Accident Claims Tribunal exempt from income tax.

For international travellers, the Tax Collected at Source (TCS) on overseas tour packages will be reduced to a flat rate of 2%.

The budget also introduces a one-time foreign asset disclosure scheme for small taxpayers and moves to decriminalize minor tax offenses to reduce litigation.